How Paul B Insurance Medicare Insurance Program Huntington can Save You Time, Stress, and Money.

Take a look at your plan's info to make certain your drugs are still covered and also your medical professionals are still in-network. Medicare health as well as drug strategies change yearly and so can your health and wellness requirements. Do you need a new medical care physician? Does your network consist of the specialist you desire for an upcoming surgery? Is your brand-new drug covered by your existing plan? Does one more strategy offer the very same value at a reduced expense? Take stock of your health standing and figure out if you require to make an adjustment.

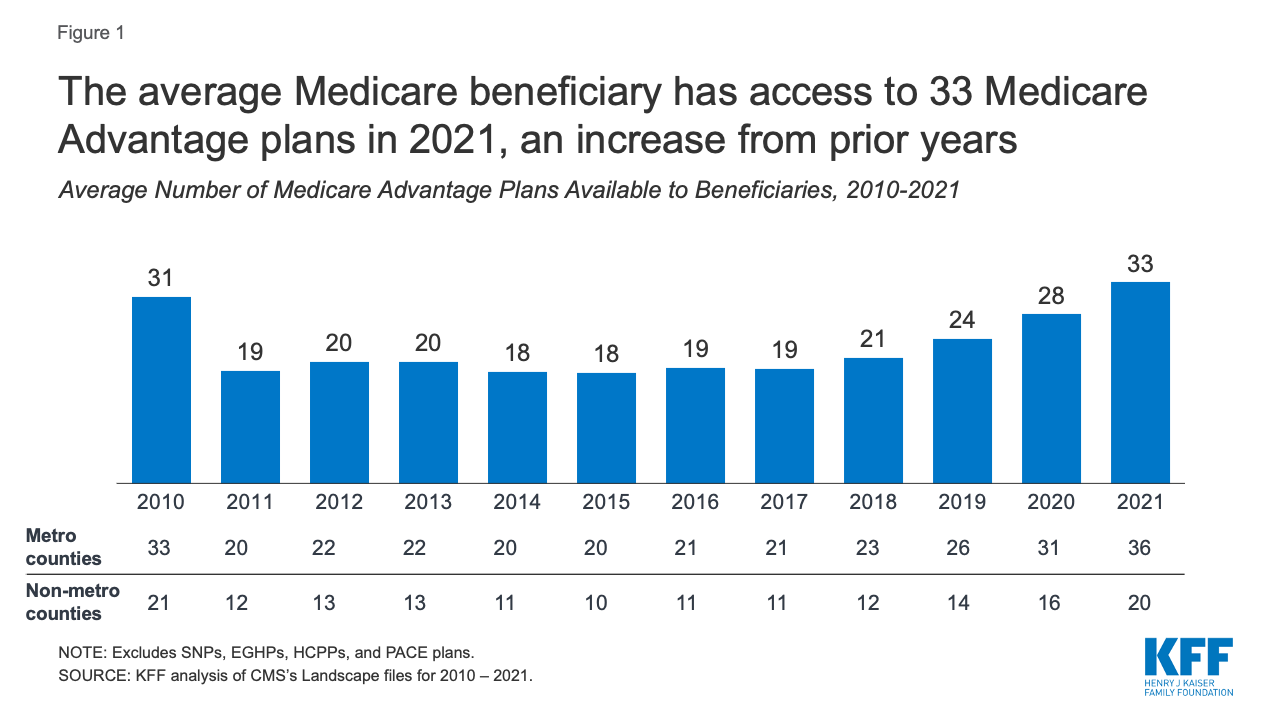

To do this, check out Medicare. Starting in October, you can make use of Medicare's plan finder tool at to see what other strategies are offered in your area.

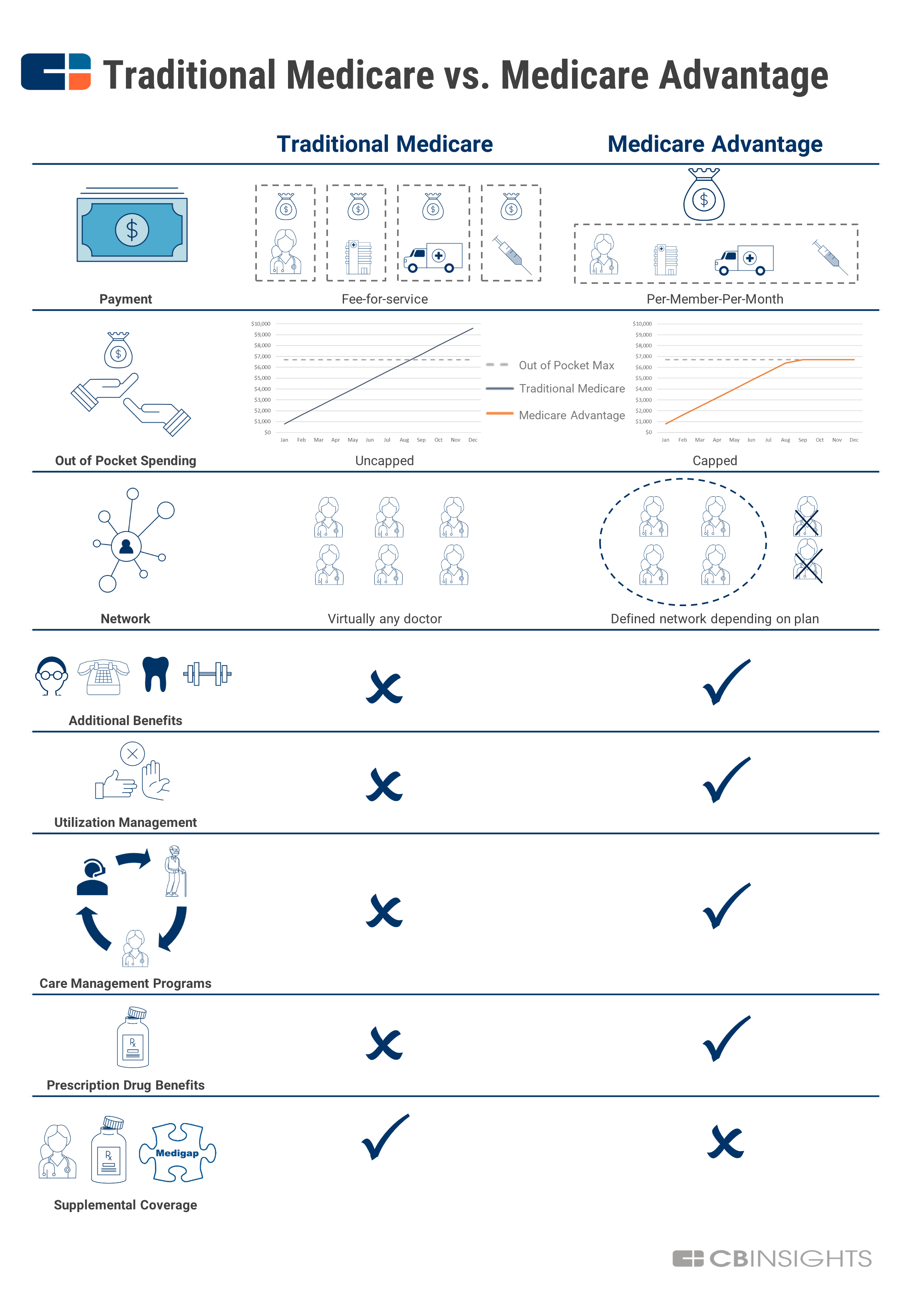

Bear in mind, during Medicare Open Registration, you can make a decision to remain in Original Medicare or join a Medicare Advantage Plan. If you're already in a Medicare Advantage Plan, you can switch over back to Original Medicare. The Medicare Plan Finder has been upgraded with the existing Celebrity Ratings for Medicare wellness as well as prescription medication strategies.

Top Guidelines Of Paul B Insurance Medicare Advantage Plans Huntington

Make Use Of the Star Ratings to contrast the top quality of health and drug strategies being offered.The State Medical insurance Support Program (SHIP) offers free, honest assistance in all 23 regions and Baltimore City with in-person and also telephone help. Volunteer possibilities are likewise readily available. For additional information concerning SHIP, pick a group below (paul b insurance local medicare agent huntington).

Along with Medicare's Annual Open Registration Period, you can capitalize on a different Medicare Advantage Open Enrollment Duration from January 1 with March 31. Unlike the Medicare Yearly Open Registration Duration, this registration period is just for people that are presently registered in a Medicare Advantage plan as well as desire to make adjustments.

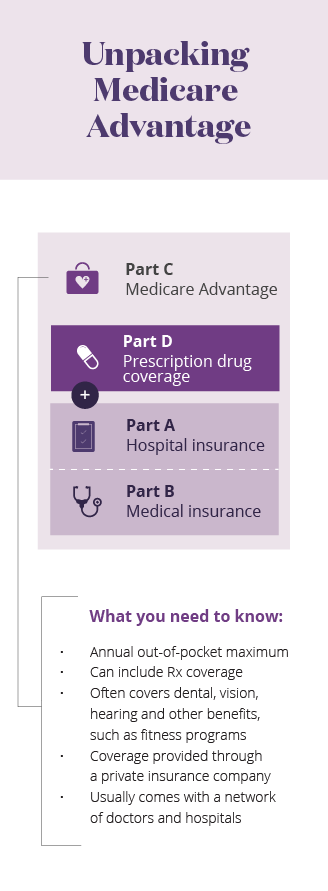

In this scenario, you will also be able to sign up with a Medicare Part D Plan. Also bear in mind that If you enrolled in a Medicare Benefit Strategy throughout your First Enrollment Duration, which is the sign up period when you first end up being eligible for Original Medicare, you can alter to an additional Medicare Benefit Strategy or go back to Original Medicare within the very first 3 months that you have coverage.

It is an excellent concept to evaluate your present Medicare strategy each year to make certain it still satisfies your requirements. To learn more concerning the Medicare Benefit open enrollment period, or aid with your testimonial and also plan comparison, get in touch with the Michigan Medicare/Medicaid Support Program (MMAP) at 800-803-7174 or see their internet site at .

Getting My Paul B Insurance Medicare Agent Huntington To Work

It is important to recognize specifically when you become eligible for Medicare to prevent any type of late registration fines. Medicare qualification can be complex, so it is very important to fully comprehend the requirements as well as understand when you become eligible. Find Medicare Plans in 3 Easy Steps, We can help discover the appropriate Medicare strategies for you today Reaching Medicare qualification can be complicated.

:max_bytes(150000):strip_icc()/medicare-automatic-enrollment-5114594_final-01copy-6e24ae7c44d441a28fb6231596c36dbb.jpg)

Each component of Medicare provides you unique advantages that make up your health and wellness insurance policy coverage. Medicare qualification is basic. When you fulfill the age or disability demands, you will instantly certify for health protection via Medicare if you are click site a UNITED STATE

How Paul B Insurance Medicare Health Advantage Huntington can Save You Time, Stress, and Money.

for at least five years.

If you are not yet 65, you might come to be eligible for Medicare based on your impairment condition. Find Medicare Plans in 3 Easy Actions, We can assist discover the appropriate Medicare plans for you today You come to be qualified for Medicare if you are: 65 years of age or older An U.S.

for at least five consecutive 5 However, there are some other circumstances in conditions you may be might for Medicare regardless of age, such as: You have been receiving home Social Security Disability Safety HandicapSSDI) for at least two years.

Not known Facts About Paul B Insurance Insurance Agent For Medicare Huntington

If you miss your IEP, you might have the ability to enroll throughout the General Registration Period (GEP), which is from January 1 to March 31 every year. Nonetheless, there may be charges for late registration, so it is necessary to sign up in Medicare throughout your Preliminary Enrollment Period ideally. The Medicare eligibility age chart below testimonials the certifications, demands, as well as eligibility age.

or a legal homeowner for a minimum of 5 years as well as: Have a diagnosis of amyotrophic side sclerosis (ALS) or end-stage kidney condition (ESRD). Obtain SSDI checks for a minimum of 24 months. You are a resident of the united state or a lawful homeowner for at the very least five years AND: Paid Medicare tax obligations for a minimum of 40 functioning quarters (one decade), so you receive premium-free Medicare Component A.

Revenue is not a variable in Medicare eligibility. You are entitled to coverage if you satisfy the standard Medicare qualification requirements. Your income will influence how much you pay for insurance coverage. If you are a high earner with an annual earnings over a particular limit, you will be in charge of extra premiums because of IRMAA.

How Paul B Insurance Local Medicare Agent Huntington can Save You Time, Stress, and Money.

Otherwise, you will need to purchase into Medicare Part A according to exactly how lots of functioning quarters you paid the tax obligation. Your premium-free Medicare Component A qualification status is offered with your account. There, you can see exactly how several eligible functioning quarters you paid Medicare tax obligations determining your Medicare Component A premium expense.

:max_bytes(150000):strip_icc()/dotdash-life-vs-health-insurance-choosing-what-buy-Final-b6741f4fd8a3479b81d969f9ea2c9bb3.jpg)